In pretty much every investing forum or group I’m in, people are asking the same thing. What’s going on and how long will it last. I certainly can’t predict how long it will last, but I can give a commonsense explanation on what’s going on.

Coronavirus or it’s official name, COVID-19 is making headlines all around the world. Worldwide stock markets are dipping into bear market territory because of it. But why?

First, let’s have a brief history lesson.

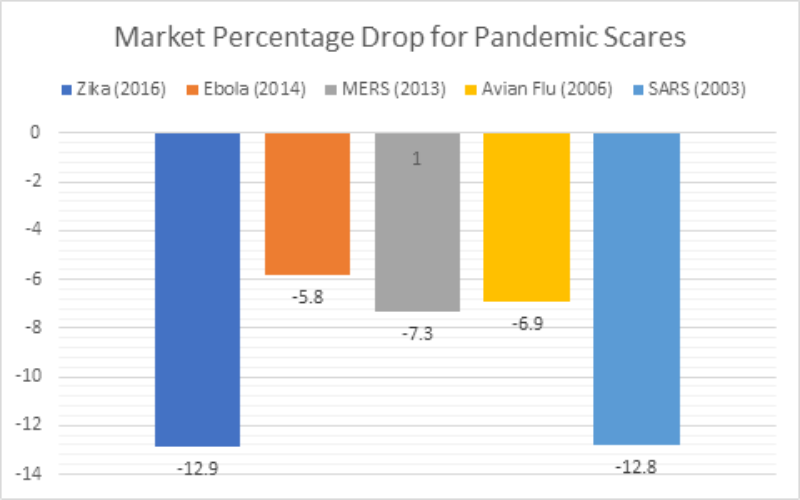

Here’s how the market reacted to Pandemic scares in the past

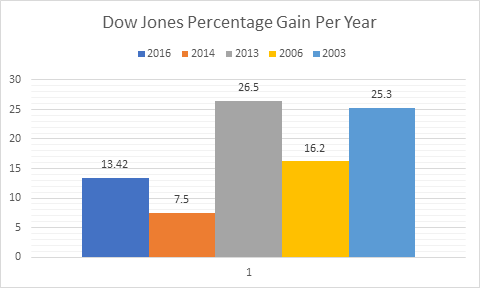

And here is how the Dow Jones performed the year of each pandemic scare

As you can see from the charts, each time there is a virus scare, the markets take a tumble. And in most cases, once hysteria gives way to common sense, the markets recover.

Now back to the question of, WHY?

Most of the stock market money is controlled by fund managers. 401Ks, ETFs, and hedge funds are all just big groups of investors who buy shares of a fund. The fund manager is the one who decides which individual equities to invest in. As the manager of a fund, that person has the fiduciary responsibility to make as much money as they can for their fund shareholders.

When the stock market tanks, these managers will try to preserve past year gains by selling poor performing assets and moving them into safer assets until the dust settles.

Many fund managers and individual investors set what’s called a “Stop Loss” order to automatically sell shares of an equity if it gets below a certain price. A market crash occurs when a dip in the market begins to trigger these orders. These orders in turn trigger more stop loss orders. Pretty soon, you have a crash.

At this point, you have a bunch of managers trying to figure out a safe place to put all the money. You may have noticed that gold and US Treasuries seem to spike whenever there is a market selloff. That is considered a safe haven for most investors. But the problem with treasuries is that they don’t give great returns, and the more people flock to them, the less returns they pay. So it’s not a long term solution, just something to stop the bleeding.

So what happens next?

We’re currently going through a phase where investors are “looking for the bottom” of the market crash. Savvy investors are scooping up shares of equities that are cheap due to the market chaos. That means that there will be a lot of seesawing back and forth until a true bottom is found and the market begins the process of recovery.

As we’ve seen in the past, the market will eventually recover it’s losses. Those who panic and sell, usually regret it. So sit tight. And if there is a stock you’ve had your eye on but passed because it was too expensive, now might be the time to take another look.