The buzzword on the lips of every financial commentator, news reporter and columnist recently has been all about interest rates. So what’s the big deal? It turns out, it’s a very big deal. And I’ll explain why…

First, let’s get some context. When people mention “the Fed rate”, they are referring to the Federal Reserve rate set by, you guessed it, the Federal Reserve. The Federal Reserve is an independent institution that is responsible for overseeing US monetary policy. How the Fed influences US interest rate policy is based on the Overnight Reverse Repurchase (ON RREP) Agreement Facility. In the simplest possible terms, Federally connected banks park their excess funds at the Federal Reserve and the Fed pays an interest rate to the banks. The Fed makes a determination based on market conditions, how much interest they are going to pay the banks.

So how does that effect us? Well, the more interest the Feds pay, the more banks are willing to park their excess money there. The effect is increased money in circulation when the rate is low (banks want to make more money by loaning it out), and decreased circulation when rates are high (banks are earning good interest so they lend less). A higher circulation (low interest rates) means the banks are more willing to loan out their (YOUR) deposits to consumers and businesses. This increased lending leads to increased economic activity and usually powers the economy forward to greatness. And the opposite effect is felt when the rates the Fed is paying are higher.

So why doesn’t the Fed just keep the rate low all the time? That’s a great question. The answer is a nasty little word called “inflation“. Remember when your grandmother used to say, “Back in my day, I could buy a honeybun and a coke for a nickel!” Well, she wasn’t lying, that’s the work of inflation. Over time, as people make more money, there is an increased demand for products. When the demand outstrips the supply, the law of supply and demand kicks in and the prices go up. That pretty much applies to all consumer goods. That’s where the Fed comes in. When the economy starts getting too hot (too much money in circulation), they raise the Fed rate so banks are encouraged to make fewer loans. Fewer loans lead to decreased economic activity and a gradual slowing of increased inflation. The stated goal of the Federal Reserve is to keep inflation between 2-3% annual growth.

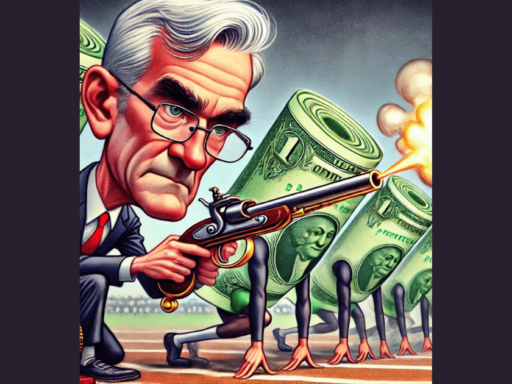

So the Fed is the reason I’m paying 18% interest on my credit card? Yes, well…kind of. Your personal interest rate is a combination of several variables: The Fed Rate + Risk + Profit. When the bank sets loan rates for the individual, the Fed rate is the starting line. You WILL NOT get a rate below this level. Next you add on the calculated risk the bank is taking on making a loan to you (your credit worthiness). And after that, it’s just good old American Capitalism (profit) at work. For example, Fed Rate 5.25 + 4 (decent credit) + 3 (profit) = 12.25% interest rate. If the Fed were to lower their rate (5.25) then, all other things being the same, the interest rate you pay would decrease in tandem. So yes, technically the Fed determines the interest rate you pay for your consumer loans.

So to sum it all up, the Fed Rate is VERY important to the everyday life of the consumer. 70% of US economic activity is based on consumer spending. So you can see why all eyes are on the Fed whenever they make a move.