The Fed’s Big Move: What Lower Interest Rates Mean for You

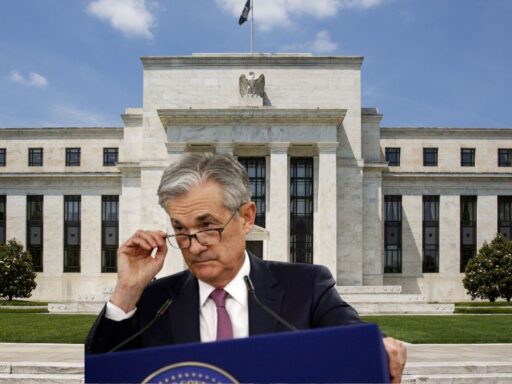

In a press conference yesterday, Federal Reserve Chairman Jerome Powell dropped some major news: the Fed will start lowering interest rates next month. For those of us who geek out over financial news, this is like Christmas morning. But what does it really mean for the economy, and more importantly, for you?

First off, let’s talk about the potential benefits. Lower interest rates can be a big win for both the economy and consumers. For the economy, it’s like adding a shot of espresso to your morning routine. Lower rates make borrowing cheaper, which can encourage businesses to invest more in growth, hire more workers, and boost overall economic activity. It’s also great news for the housing market—lower mortgage rates mean it’s easier and more affordable for people to buy homes, which can lead to an uptick in home sales.

For the average consumer, lower interest rates can mean cheaper loans and credit card interest rates. Planning to buy a car, a home, or even just looking to refinance your existing mortgage? You might be able to lock in a lower rate and save some serious cash. Plus, if you’re carrying any debt, the interest you’re paying on that debt could decrease, easing some of the financial burden.

But it’s not all sunshine and rainbows. While lower rates can boost spending and investment, they can also lead to lower returns on savings accounts and bonds, which might not be great news for savers.

As the Fed gradually lowers rates over the next year, keep an eye on how these changes impact your financial decisions. Whether you’re looking to invest, save, or spend, understanding how interest rates affect the economy can help you make smarter money moves.

So, while we might not have a crystal ball, it’s safe to say that the next year could bring some interesting opportunities for both the economy and your wallet. Stay tuned, and keep investing wisely!