Table of Contents

Understanding the Long-Term Benefits of Investing

When it comes to managing personal finances, many people face the choice of investing in the stock market or keep their money in a traditional savings account. It’s natural to feel cautious about risking hard-earned money, especially with the possibility of stock market crashes looming large. However, while saving accounts feel safe, they can actually erode wealth over time due to inflation. Meanwhile, the stock market—despite its ups and downs—has consistently provided long-term growth for those who stay the course.

It’s no secret that the stock market experiences volatility. There are market corrections, crashes, and unpredictable fluctuations. However, history has shown that over the long term, the market tends to recover and grow. For instance, the S&P 500 has delivered average annual returns of about 10% over the past several decades.

Example: $1,000 Invested Over the Last 10 Years

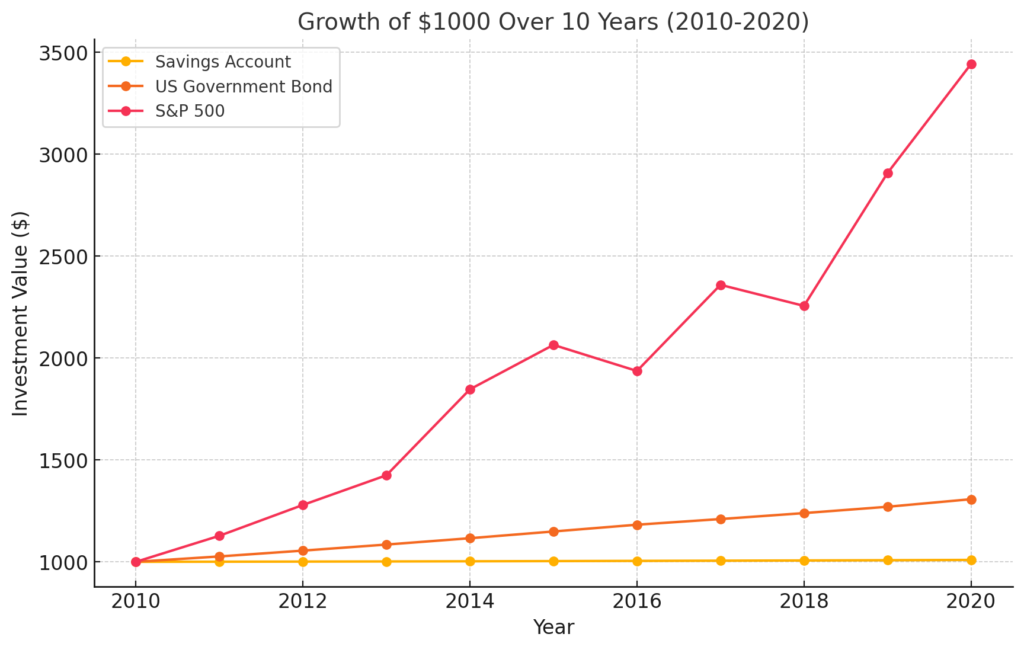

If you had invested $1,000 in the S&P 500 at the beginning of 2010 and left it untouched until 2020, it would have grown substantially. With the stock market’s performance averaging 13% annual growth, that $1,000 would have more than tripled, resulting in a total of approximately $3,400 by 2020.

In contrast, if you had left that $1,000 in a traditional savings account, where interest rates typically range from 0.05% to 0.15% per year, the growth would be minimal. After 10 years, you might end up with only $1,010 to $1,020—barely more than your initial deposit.

The Impact of Inflation on Savings

One of the biggest dangers of relying solely on savings accounts is the impact of inflation. Inflation refers to the gradual rise in the cost of goods and services over time, which decreases the purchasing power of money. While inflation fluctuates, it has averaged around 2% to 3% per year over the past several decades.

Let’s look at the example of $1,000 kept in a savings account for 10 years. Even if inflation averages 2% per year, the purchasing power of that money diminishes. What could buy $1,000 worth of goods in 2010 might only be able to purchase about $820 worth of goods in 2020. So, while the actual amount in the account doesn’t decrease, its value does, because the cost of living increases faster than the interest you’re earning.

How U.S. Treasuries Compare

Investing in U.S. government bonds, such as Treasuries, offers a middle ground between savings accounts and the stock market. Treasuries are considered safer than stocks but offer higher returns than savings accounts. Over the past decade, U.S. Treasuries have provided annual returns of around 2.5% to 3%.

Using our $1,000 example, if you had invested in U.S. Treasuries in 2010, you could have earned roughly $1,280 by 2020. While this is certainly better than keeping your money in a savings account, it still falls short of the growth you would have seen in the stock market.

Facing the Fear of a Market Crash

One of the primary reasons people hesitate to invest in the stock market is the fear of losing money during a crash. While it’s true that the stock market goes through corrections and bear markets, history shows that it always recovers over time. For example, during the 2008 financial crisis, the market saw significant losses, but by 2013, it had fully rebounded and continued to grow substantially.

Investing in the stock market requires patience. The key to weathering market volatility is to think long term and avoid making emotional decisions. While short-term losses can be alarming, long-term investors who stay invested through the ups and downs are typically rewarded.

Why Investing Is a Better Long-Term Strategy

Compounding Growth: One of the biggest advantages of investing in the stock market is the power of compound returns. When you reinvest your earnings (such as dividends), your money grows exponentially over time. The longer you stay invested, the more your investments will grow.

Beating Inflation: The stock market historically delivers returns that outpace inflation, meaning your purchasing power grows along with your investments. This contrasts sharply with savings accounts, where inflation erodes the value of your money.

Diversification Opportunities: By investing in a diverse mix of stocks or index funds (like the S&P 500), you spread out your risk and increase your chances of benefitting from market growth. Investing doesn’t mean putting all your eggs in one basket; it means smartly allocating your money to maximize gains and minimize risk.

Conclusion

While savings accounts and U.S. Treasuries offer safety and security, they also come with the hidden cost of lost purchasing power due to inflation and low returns. On the other hand, the stock market provides an opportunity to grow wealth over time, despite its inherent risks. Historically, the market has rewarded long-term investors, offering returns that far outpace both savings accounts and bonds.

If you’re new to investing, it’s understandable to feel apprehensive. But with the right knowledge and a long-term mindset, you can make your money work for you and build a more secure financial future.

Would you rather watch your money lose value, or take advantage of the market’s growth potential? The choice is yours, but history shows that investing is the better long-term strategy.